For over a century, the Yukon has lured prospectors with the promise of big discoveries. The Klondike defined a generation of fortune-seekers, and today a new wave of companies and investors are rushing north. This time not with pans and picks, but with drill rigs and balance sheets.

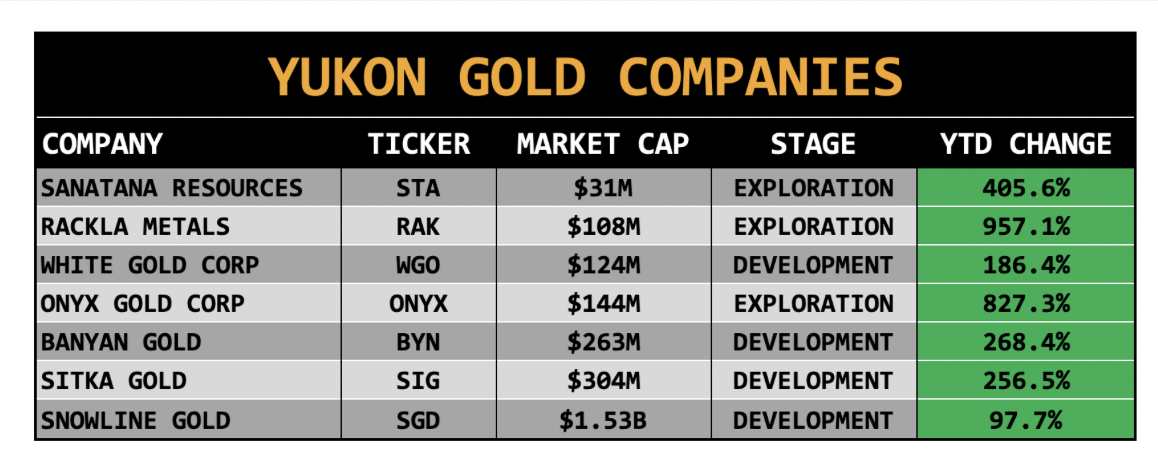

In 2025, the Yukon has re-emerged as one of Canada’s hottest exploration districts. Share prices across the board have soared, financings have come easily, and majors are circling as juniors outline new multi-million-ounce deposits. The numbers are striking: Rackla Metals is up more than 950% year-to-date, Onyx Gold has surged 827%, and even the larger players like Banyan and Sitka have doubled or tripled.

At the center of it all is Snowline Gold, whose Valley deposit has quickly grown into one of the most significant discoveries in recent Canadian mining history. But as the tide rises, a new generation of explorers, including Sanatana Resources (TSXV: STA), is moving into the spotlight.

Yukon Momentum Builds

The bullish turn in the Yukon didn’t happen overnight. It’s been building for years, with early believers pointing to the geological promise of the Tombstone Belt and the White Gold District. Rick Rule recently noted that more than 20 million ounces of gold have already been discovered in just a 100 km stretch of the Tombstone Belt, underscoring its district-scale potential.

But investor sentiment has swung with events. In 2024, Victoria Gold’s heap leach failure and subsequent bankruptcy cast a temporary shadow over the Yukon. Yet that episode now looks more like an isolated operational failure than an indictment of the territory. By 2025, confidence had roared back. Explorers have raised nearly $200 million so far this year, and discovery success has been rewarded with outsized share price gains.

The majors are watching closely. B2Gold holds a position in Snowline, Agnico Eagle owns nearly 20% of White Gold Corp, and Kinross has previously been active in the district. The hunt is on for deposits of 5Moz and larger, and the Yukon is one of the few jurisdictions capable of delivering them.

Sanatana Resources: A Strategic Position Beside Valley

While Snowline’s Valley discovery may have kicked off the current wave of enthusiasm, companies like Sanatana are positioning themselves to benefit from the district-scale nature of reduced intrusion-related gold systems (RIRGS).

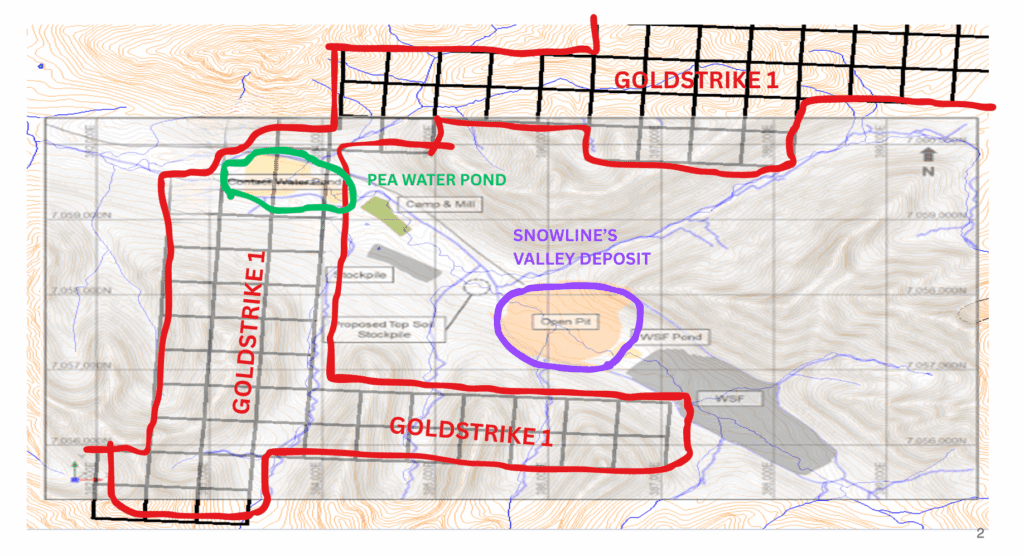

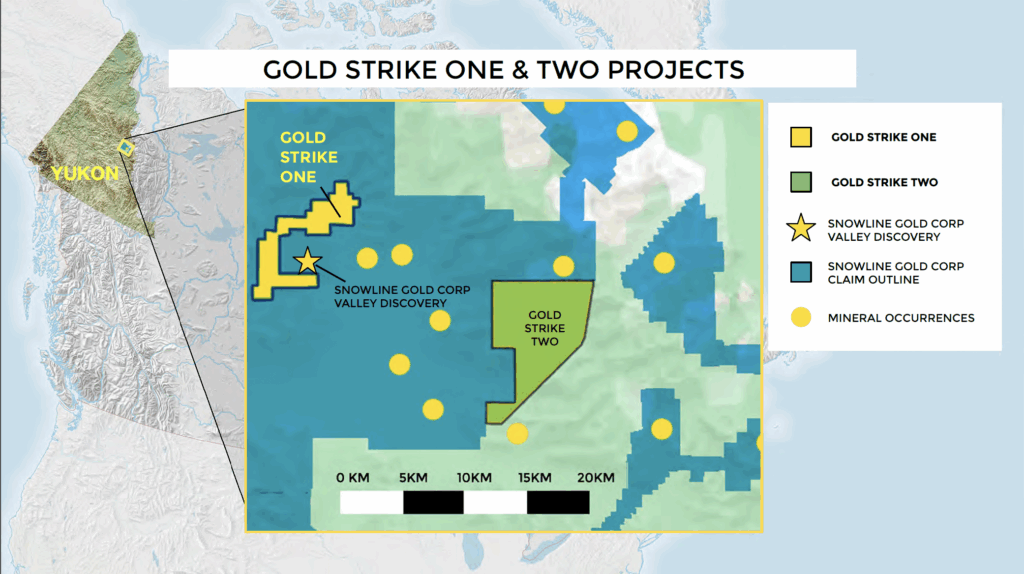

Sanatana recently announced the acquisition of Gold Strike One, a project that partially surrounds Snowline’s Valley deposit.

The southern boundary lies within 500–650 metres of Valley’s interpreted pitshell, giving Sanatana one of the most strategic land positions in the region. Early geochemical work has outlined strong gold-in-soil anomalies, with pathfinder elements (arsenic, bismuth, antimony, copper) consistent with Valley’s mineralizing system. Rock samples have returned up to 1,480 ppb gold.

Complementing this is Gold Strike Two, located 15 km east-southeast of Valley, where sheeted quartz veins and anomalous stream sediments have already been identified. Together, the two projects give Sanatana a strong foothold in the Rogue Plutonic Complex.

In 2025, Sanatana is funded for fieldwork, including soil and rock sampling plus geophysics, with the aim of refining targets for drilling. The company plans to rebrand as Gold Strike Resources Corp. later this year, reflecting its Yukon focus.

With a market cap of just $31M, Sanatana remains one of the smallest names in the Yukon peer group, yet it sits in the immediate neighborhood of one of the biggest discoveries. That combination of strategic ground and modest valuation explains why the stock has already gained more than 400% YTD.

The Peer Group: Everyone’s Winning

The resurgence of Yukon gold isn’t just about one or two companies, it’s a sector-wide phenomenon.

- Rackla Metals (TSXV: RAK, $108M cap) – Up nearly 957% YTD as maiden drilling at the Grad property confirms high-grade RIRGS-style gold.

- Onyx Gold (TSXV: ONYX, $144M cap) – Up 827% YTD, advancing its King Tut project with high-grade surface samples and expanded targets.

- Banyan Gold (TSXV: BYN, $263M cap) – Up 268% YTD, with its AurMac project now hosting ~7Moz inferred resources.

- Sitka Gold (TSXV: SIG, $304M cap) – Up 257% YTD, RC Gold continues to deliver broad, consistent intercepts across multiple intrusions.

- White Gold (TSXV: WGO, $124M cap) – Up 186% YTD, controlling 40% of the White Gold District with Agnico Eagle as a major backer.

- Snowline Gold (TSXV: SGD, $1.53B cap) – Up 98% YTD, Valley has grown to 8.8Moz and a PEA outlines a 20-year mine life.

The message is clear: investors are rewarding Yukon exposure across the board.

A Modern-Day Gold Rush

With gold trading strong and capital markets flowing, the Yukon is once again proving why it’s one of Canada’s most compelling exploration frontiers. Multiple district-scale deposits are emerging, and the majors are circling with an eye on long-life, multi-million-ounce mines.

For investors, the opportunity lies in finding the companies with strategic ground and significant torque to the upside. Snowline has already been rerated into the billion-dollar club. Rackla, Onyx, Sitka, Banyan, and White Gold have all seen their valuations surge.

Sanatana Resources, with projects directly adjacent to Valley and a market cap still under $35M, represents one of the most leveraged ways to play this modern Yukon gold rush. As exploration results roll out in 2025, the spotlight could shift quickly.

The Klondike of the 1890s may be history, but for today’s investors, the Yukon’s next chapter is just beginning.

DISCLAIMER: The author did not receive any compensation for publishing this article. The author holds a position in Sanatana Resources and may choose to buy or sell shares of the company at any time without notice. The author does not hold positions in any of the other companies mentioned. While reasonable efforts have been made to ensure the accuracy and reliability of the information provided, readers are encouraged to conduct their own research and seek independent financial advice before making any investment decisions related to the companies discussed.