Every boom has a moment when the biggest winners seem obvious, the billion-dollar names everyone hears about on social media.

But the investors who consistently pull in the biggest returns aren’t chasing the headlines. They’re hunting for the overlooked leverage points that the crowd hasn’t discovered yet.

And in the middle of the most powerful gold rush the Yukon has seen in decades, that leverage belongs to a tiny $35 million explorer called Gold Strike Resources (TSXV: GSR).

Through a rare combination of timing, geology, and geography, Gold Strike now controls the single most important piece of land required by a neighboring $2.5 billion gold discovery.

It is a setup so unusual, and so asymmetrical, that it has the potential to reshape valuations across the entire district. And the wider retail market still has no idea it exists.

The Discovery That Ignited the Yukon Gold Rush

A few years ago, a company most retail investors had never heard of, Snowline Gold, drilled into what would become one of the largest new gold discoveries in Canada.

The results were so strong, so consistent, and so scalable that the company’s valuation didn’t just climb… it exploded. Snowline rocketed into the $2.5 billion range, making it the hottest exploration success story in the entire country.

Institutions piled in. Analysts raised targets. The Yukon became a global focus for the next wave of tier-one discoveries.

But beneath all the excitement is a structural problem the market only recently began to understand.

Snowline built its discovery in the worst possible location: a dead-end valley where there is only one workable direction to build roads, haul ore, store water, and develop the infrastructure a real mine requires.

- Every other direction is blocked by mountains.

- And that one direction, the only physical path a multibillion-dollar mine can use, runs straight through Gold Strike Resources property.

The Bottleneck No One Saw Coming

To take a gold discovery from early results to a producing mine, a company must secure:

- A legally accessible road for heavy equipment

- Land for a water management system

- Room for rock storage, trucks, and infrastructure

- A clear path for permitting and construction

Snowline cannot place any of these on the east, north, or south sides of the valley. The terrain makes it physically and logistically impossible.

The only place left, the only way the mine can function, lies directly on land owned by Gold Strike Resources.

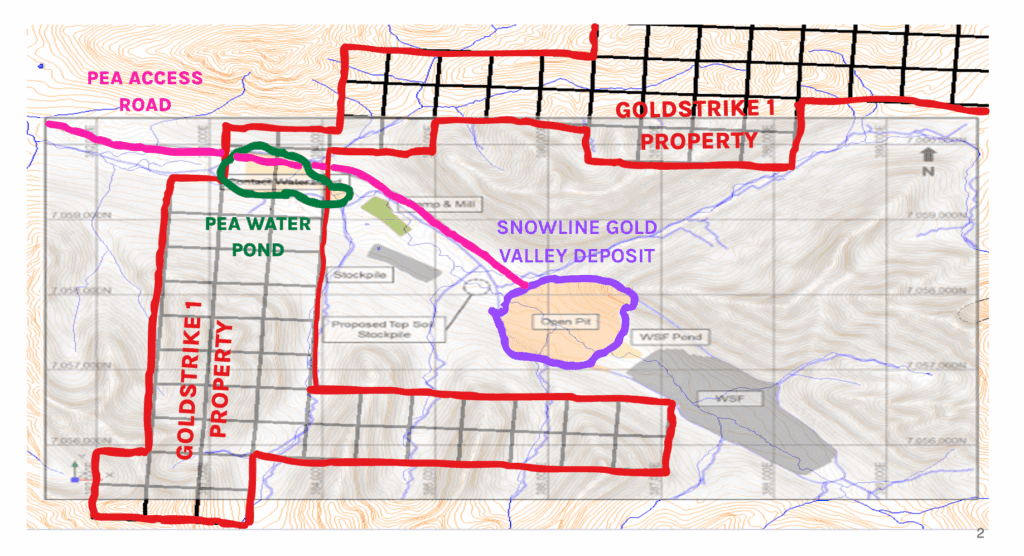

Just look at the map…

This isn’t theory. It isn’t speculation. It’s stamped into Snowline’s own engineering documents submitted to regulators. Their road crosses GSR land. Their water pond crosses GSR land. And the maps show no alternative routes.

A $2.5 billion company cannot build its mine unless a $35 million microcap agrees.

This is what mining veterans call a toll-booth position. And toll booths tend to get paid.

The Strategic Value the Market Hasn’t Priced In

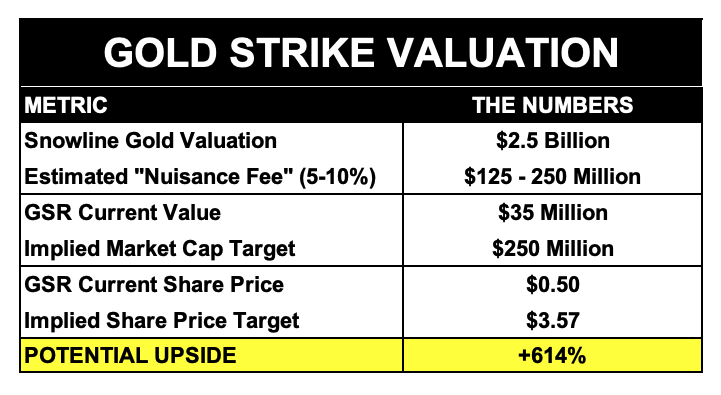

In mining, strategic land, especially land controlling access to a major deposit, is often valued at 5 to 10 percent of the larger company’s market cap. This isn’t hype. It’s industry precedent. It’s what major producers regularly pay to eliminate bottlenecks before an acquisition.

Apply that to Snowline:

Even the conservative end implies a +614% re-rating for GSR simply to align with normal industry logic.

The Free Upside Everyone Is Missing

But while the market focuses on the land access story, the part that makes this opportunity truly explosive is that Gold Strike isn’t just blocking the road, it’s sitting on the same gold system that produced Snowline’s discovery.

Gold Strike controls strategic land, yes, but it also controls ground with the same geological fingerprint as Snowline’s monster deposit.

- They share the same rock types.

- They share the same structural trends.

- They share the same mineralized corridor.

- Early sampling has already revealed gold right at surface.

That means two things:

- If Snowline wants to clean up the map, they must negotiate with GSR.

- If GSR hits even one meaningful drill hole, the stock could reprice instantly.

Most microcaps have to fight for relevance. GSR is relevant by default—and the exploration is simply a second engine of upside the market is still ignoring.

The Clock Is Already Ticking

Gold is breaking all-time highs. Institutional interest in the Yukon is accelerating. Snowline is advancing its project aggressively.

And every step they take increases the pressure around the land bottleneck they do not control.

Gold Strike Resources is not just another Yukon explorer. It is the gatekeeper to a $2.5 billion gold mine.

For investors who understand how leverage works in mining, this is the type of opportunity that appears rarely—and disappears quickly.

The window is open now. The question is how long it stays open.