The world is at a geopolitical inflection point. From Ukraine’s frontlines to the Middle East and now simmering tensions across Asia-Pacific, drones have emerged as the defining technology of modern warfare. Small, autonomous, and lethal — they are no longer toys for hobbyists but critical tools of statecraft and defense.

Investors have noticed. Shares of Draganfly ($DPRO) are up 67% this month. Drone Delivery Canada ($FLT) has soared 328%. Defense budgets are swelling, and autonomous systems are at the top of every procurement wish list.

But there’s one company that hasn’t yet joined the rally.

Mobilicom ($MOB), a Nasdaq-listed cybersecurity and drone tech innovator, is criminally overlooked. With a market cap of $25M, $8.6M in cash, no debt, and a high-margin business embedded with Tier-1 drone OEMs, it’s positioned to be the next breakout in the drone tech space.

At the Crossroads of Drones, AI, and Cybersecurity

It’s rare to find a company operating at the center of three of the market’s hottest sectors — yet that’s exactly where Mobilicom sits.

Drones have transitioned from niche gadgets to indispensable tools of modern warfare and critical infrastructure. Ukraine’s battlefields and the Middle East’s skies have made it clear: autonomous systems are no longer optional for militaries.

At the same time, artificial intelligence has become the beating heart of autonomy, enabling drones to sense, decide, and act without human intervention. From AI-driven targeting systems to autonomous swarm capabilities, the defense sector is racing to deploy these innovations.

Overlaying all of this is cybersecurity, arguably the most urgent layer. As drone warfare escalates, so does the threat of hacking and electronic warfare. In Ukraine alone, Russia’s cyber-attack stations are reportedly neutralizing up to 90% of incoming drones. Without robust cybersecurity, even the most advanced drones are sitting ducks.

Mobilicom’s strength lies in bringing these worlds together. Its end-to-end platform combines field-proven cybersecurity, AI-enabled autonomy systems, and mission-critical hardware, making it a true enabler of next-generation drone capabilities.

Blue UAS Certified: A Fast-Track to Pentagon Procurement

Mobilicom is among a select group of companies included in the U.S. DoD’s Blue UAS framework, an initiative that vets and fast-tracks deployment of secure drone technology. This certification streamlines procurement by U.S. federal agencies and NATO allies, giving Mobilicom a clear competitive edge. It’s a significant advantage as Washington phases out Chinese-made drones and accelerates its investments in autonomous systems under the $1 billion Replicator initiatives.

Demand Surging as Drone Warfare Goes Mainstream

Recent conflicts underscore why demand for secure autonomous systems is growing exponentially. In Ukraine, as many as 200,000 drones are being lost each month to Russian electronic warfare systems. Across the Middle East, Iran, Israel, and their proxies are deploying thousands of drones in active combat. Even India and Pakistan have entered what some are calling the world’s first drone war between nuclear-armed neighbors. Meanwhile, the United States is preparing for potential conflict with China by pouring billions into autonomous drone programs.

Mobilicom’s cybersecurity and communications technologies are tailor-made for these realities, providing a critical layer of protection and functionality.

Financials: Strong Balance Sheet, Deep Value

Mobilicom’s numbers are surprising for a company its size:

| METRIC | $MOB | $PDYN | $UMAC |

| Market Cap (US$) | $25M | $313M | $306M |

| FY 2024 Revenue | $3.18M | $7.79M | $5.57M |

| P/S | 7.8x | 40.1x | 54.9x |

| Gross Margin | 57.6% | 55.2% | 27.8% |

| Cash/EV | 180% | 17% | 3% |

| Debt | $0 | $0 | $3.3M |

At a glance, Mobilicom’s fundamentals look compelling. Revenues grew 45% year-over-year to $3.18 million in 2024, with gross margins holding strong at nearly 58%. The company’s cash position of $8.6 million covers more than half its enterprise value, while zero debt and a low burn rate of around $267,000 per month provide a long runway. EBITDA losses improved by 18% last year, and the company has a $1.1 million backlog set to be fulfilled in the first half of 2025.

In a sector where peers like Palladyne AI ($PDYN) trade at 40x P/S and Unusual Machines ($UMAC) at 55x, Mobilicom sits at just 7.8x. If $MOB were to trade at a peer multiple of 40x, it would be valued at $127M — or roughly $17 per share. The gap is hard to justify given its margins, cash position, and Blue UAS certification.

Technical Picture Points to Breakout

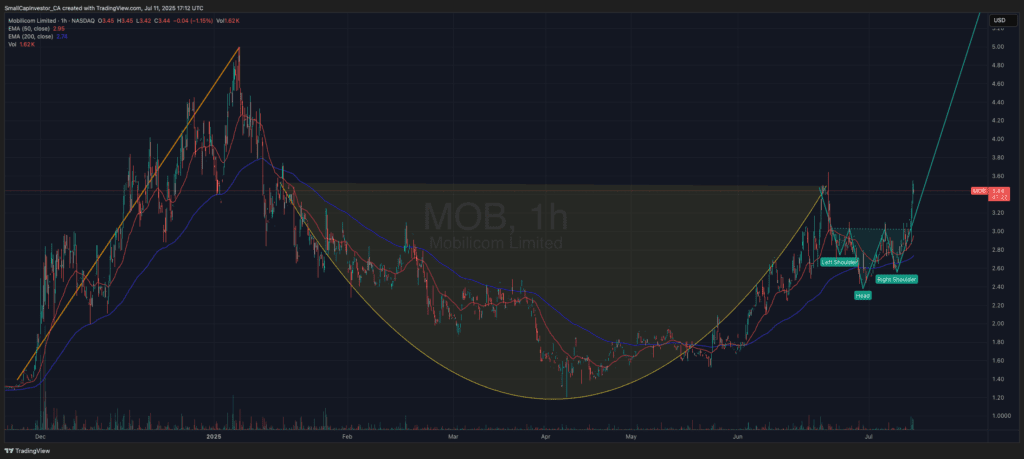

On the chart, $MOB is painting a textbook cup-and-handle pattern, a bullish formation often seen before major price moves. After a prolonged rounding bottom from February through June, the stock broke out of the handle in early July, confirming the setup. Adding fuel to the fire, a clear inverse head-and-shoulders pattern has formed within the handle — another bullish reversal signal.

The breakout above $3.20 has triggered strong volume, and momentum indicators are now aligning for a potential parabolic move. With little overhead resistance until the $5.00–$5.50 zone, $MOB could be setting up for a measured move rally. If the pattern plays out to its full extension, the technical target aligns closely with prior highs near $6.00.

Growth Catalysts Are Lining Up

With Tier-1 OEMs ramping to mass production, DoD Programs of Record adoption underway, and new product launches such as OS3 and next-generation controllers, Mobilicom is positioned for significant near-term revenue inflection. Strategic partnerships with Airbus, Aitech, and DT Research further strengthen its position, while follow-on production orders from U.S., Israeli, and Asian Tier-1 customers provide tangible validation.

Bottom Line

Mobilicom sits at the intersection of cybersecurity, AI, and autonomous systems, in a world where drones are becoming the defining technology of 21st-century warfare. Unlike peers commanding $300 million valuations, Mobilicom trades at just $25 million despite having superior margins, no debt, and coveted Blue UAS certification.

With technicals pointing to an imminent breakout and fundamentals screaming deep value, this could be the last chance to accumulate before the market catches on.

DISCLOSURE

The author did not receive any compensation for publishing this article. The author owns shares of Mobilicom Ltd and may choose to buy or sell at any time without notice. While the author has made reasonable efforts to ensure the accuracy and reliability of the content, readers should conduct their own research and analysis and seek independent financial advice before making any investment decisions related to the small cap company mentioned.