After more than a decade in the shadows, the commodities market is roaring back to life — and early signs point to the beginning of a powerful, multi-year supercycle.

Across the board, prices of hard assets are surging. Gold has broken all-time highs, silver is rallying on industrial demand, and copper is hitting new records on the back of electrification. Yet until recently, junior mining equities — the small-cap exploration and development stocks most leveraged to commodity prices — remained largely ignored.

That’s starting to change.

2025 has seen a decisive shift in sentiment toward the junior resource space. Public companies that were trading near 52-week lows in January have suddenly doubled or tripled. Financings are reopening. Capital is starting to flow.

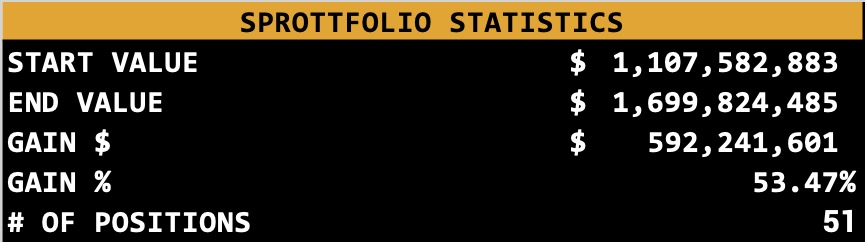

And perhaps most notably, billionaire resource investor Eric Sprott’s junior-heavy portfolio is up over 53% year-to-date, generating nearly $600 million in gains across 51 small-cap mining positions. His performance isn’t the cause of the supercycle — but it’s a strong signal that it’s already underway.

What Is a Commodities Supercycle?

A commodities supercycle is a long, sustained period of rising commodity prices driven by structural demand growth, limited new supply, and broad macroeconomic shifts. Think early 2000s — when China’s industrial rise triggered a 10-year boom in everything from copper to coal.

This time, however, the drivers are more global, more complex — and arguably even more powerful.

Key Drivers of the 2025 Supercycle

1. Gold Is Breaking Out — And It’s Not Just About Inflation

Gold is doing what it was built to do: act as a store of value in times of instability.

In 2025, the yellow metal has blown past $3,400/oz, fueled by:

- Historic central bank buying, especially from China, Turkey, and Russia

- De-dollarization, as countries seek alternatives to U.S. treasuries

- Persistent inflation, even after aggressive monetary tightening

- War and geopolitical risk, from Ukraine to the Red Sea to Taiwan

- Sovereign debt overload, now exceeding $315 trillion globally

Gold is no longer just a hedge — it’s becoming a central pillar of monetary strategy around the world.

2. Silver Demand Is Exploding — Just As Supply Tightens

Silver sits at the intersection of precious and industrial — and both sides of that equation are booming.

- Solar panel production now accounts for over 160M ounces per year

- EVs and charging infrastructure are increasingly silver-intensive

- Electronics, medical, and AI tech continue driving consumption

- Mine supply is stagnant, especially in Latin America

- Few new projects are coming online, due to permitting and ESG pressure

Despite this, many silver juniors are still trading at fractions of their 2020 valuations. That’s starting to change — and fast.

3. Copper Is the Bottleneck of Electrification

You can’t build a decarbonized future without copper.

EVs, wind turbines, grid infrastructure, data centers, AI power systems — all of it runs through copper wiring. But supply? It’s running on fumes.

- New discoveries are scarce

- Project development timelines are long

- Ore grades are declining globally

- Political risk is rising in key producing nations like Chile and Peru

Copper recently broke above $5/lb — and some analysts now see $6–$7/lb as possible in the next 12 months. Yet most junior copper equities remain dramatically undervalued relative to the price move.

Junior Mining Equities: The Last to Move, Now Catching Up

For much of the past two years, commodity prices moved while junior equities lagged. That disconnect is finally resolving — in favor of the juniors.

One example? The performance of Eric Sprott’s portfolio, which includes over 50 publicly disclosed junior gold and silver companies.

- Portfolio value: $1.7 billion

- YTD gain: $592 million

- Performance: +53.47%

Sprott’s gains weren’t driven by large-cap producers or ETFs — they came from deep value exploration plays, many of which were forgotten by the broader market. Stocks like Discovery Silver, Freegold Ventures, and Erdene Resourcehave delivered 2x–4x returns year-to-date, as capital finally rotates back into the sector.

His results are just one example — but they illustrate a bigger point: the market is waking up to the leverage that juniors offer in a rising commodity environment.

Why This Supercycle May Be Different

Past commodity booms were largely driven by one or two regions (like China). This time, the drivers are global, and they cut across sectors:

- AI infrastructure and EVs in North America

- Grid expansion and solar buildout in Europe

- Raw material hoarding and reserve accumulation in Asia

- Defense spending, inflation hedging, and commodity nationalism worldwide

At the same time, supply chains are fragile, permitting timelines are longer than ever, and capital investment into new mines has lagged for over a decade. The result? A setup where demand keeps accelerating, but supply can’t keep up.

That’s a recipe for a long-lasting bull market — and the juniors, once again, are starting from a deep discount.

Final Thoughts: The Rotation Has Begun

The signals are clear:

Gold is making new highs

Silver demand is outpacing supply

Copper is entering scarcity mode

Junior equities are finally outperforming

Whether you’re an institutional investor or a retail speculator, the message is the same: the commodity cycle has turned — and the juniors are back in play.

Those who recognized this shift early — like Eric Sprott — are already seeing the rewards. But for the broader market, this still looks like the first inning of a much bigger move.

Disclaimer: The information in this article is for informational purposes only and does not constitute financial advice. The author does not own any of the stocks mentioned. While efforts have been made to ensure the accuracy of the data and numbers provided, they may not be accurate or up-to-date. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.