This morning, Military Metals Corp. (CSE: MILI | OTCQB: MILIF) announced grab sample results of up to 40.6% antimony and 106.5 g/t gold from its historic West Gore project in Nova Scotia, reinforcing its position as a key player in the West’s critical mineral supply chain.

Here’s why this news—and Military Metals’ broader strategy—could be pivotal for investors as the antimony supply crisis deepens…

As the 21st century unfolds, a new kind of arms race is emerging—not for nuclear stockpiles or oil reserves, but for the critical minerals that underpin modern militaries and energy systems. Among these, one of the most strategically vital yet least understood is antimony.

Long relegated to the margins of commodity markets, antimony is suddenly at the center of global concern. It’s used to harden bullets, fireproof military equipment, and manufacture semiconductors and solar panels that power defense and civilian infrastructure alike. Yet for all its importance, the West produces almost none of it.

This gaping vulnerability has governments scrambling and investors paying attention. Enter Military Metals Corp. (CSE: MILI | OTCQB: MILIF)—a small-cap company that has quietly built one of the most compelling antimony portfolios in the Western Hemisphere. With projects in Canada, Europe, and the United States, Military Metals could play a pivotal role in rebuilding secure supply chains for a mineral the U.S. Department of Defense considers critical to national security.

Antimony: A Critical Mineral With a Wartime Legacy

To grasp antimony’s importance, one need only look to history. During both World Wars, antimony was an unsung hero. It was alloyed with lead to produce bullets and shrapnel capable of withstanding high velocities. Antimony trioxide was used as a flame retardant to protect soldiers’ tents and uniforms from incendiary attacks. In fact, U.S. military historians credit antimony-based fireproofing compounds with saving countless lives in combat zones.

Today, antimony’s applications have only grown. It’s essential in night vision goggles, infrared sensors, armor-piercing rounds, and communications systems. Beyond the battlefield, it’s used in semiconductors, large-capacity batteries, and high-quality glass for everything from smartphones to solar panels.

The problem? The United States consumes over 50 million pounds of antimony annually but produces none domestically. Nearly 80 percent of global supply comes from China, Russia, and Tajikistan—two of which are either strategic adversaries or under sanctions.

China’s Export Ban and the New Resource Cold War

In September 2024, China imposed state-controlled export restrictions on antimony, citing “national security” concerns. Prices surged to $60,000 per tonne, nearly triple pre-ban levels, sending shockwaves through industrial and defense supply chains.

The U.S. House Armed Services Committee soon warned: “Geopolitical dynamics with Russia and China could accelerate supply chain disruptions, particularly with antimony.”

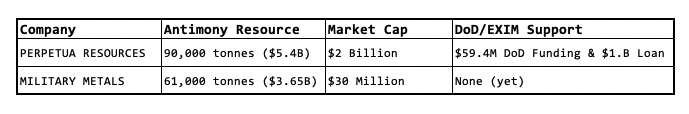

The Pentagon responded by backing Idaho-based Perpetua Resources (TSX: PPTA) with $59.4 million in Defense Production Act funding and supporting a potential $1.8 billion loan from the U.S. Export-Import Bank. Stibnite, Perpetua’s flagship project, produced 90 percent of America’s antimony during World War II, helping to shorten the war by an estimated year.

But even if fully operational, Stibnite would meet only about 35 percent of U.S. antimony demand. As Military Metals CEO Scott Eldridge puts it, “The U.S. will require multiple antimony projects to satisfy its domestic consumption demands.”

This reality sets the stage for Military Metals’ rise—and a potential revaluation that could reward early investors.

Military Metals Corp: A Strategic Portfolio Across the West

Unlike many junior miners chasing gold or lithium hype, Military Metals has taken a focused approach: acquire high-potential antimony projects in stable, Western-aligned jurisdictions.

The company now holds three core assets: West Gore in Nova Scotia, Trojarova and Tiennesgrund in Slovakia, and Last Chance in Nevada. Each site has historical production, existing infrastructure, and significant exploration upside.

West Gore: Canada’s Wartime Producer Reawakens

The story of West Gore in Nova Scotia reads like a chapter from a World War I history book. Between 1882 and 1939, it was Canada’s largest antimony producer, supplying high-grade concentrate (46 percent Sb) critical to the Allied effort.

But in 1917, tragedy struck. A shipment of antimony bound for Wales was torpedoed by a German U-boat. The loss bankrupted the operator and left the mine dormant for decades.

Today, Military Metals is reviving West Gore with modern exploration techniques—and the results are turning heads. On July 22, 2025, the company announced grab sample results from a historical mine stockpile showing grades up to 40.6% antimony and 106.5 grams per tonne (gpt) gold. The five samples averaged an impressive 17.94% antimony and 34.68 gpt gold, reaffirming historical reports of high-grade mineralization.

Adding near-term value, waste rock dumps on site contain an estimated 570 tonnes of antimony and 2,500 ounces of gold—worth over $34 million at current prices. The company has also identified three high-priority drill targets never previously tested, with drilling plans now being finalized.

Nova Scotia’s government, led by Environment Minister Tim Halman, recently announced updates to the approval process for metal-mining projects aimed at accelerating timelines. These regulatory changes are expected to streamline permitting and support critical mineral development, giving Military Metals a timely tailwind.

Trojarova: Europe’s Strategic Antimony Asset

In Western Slovakia, Military Metals controls Trojarova, located near Pezinok, a town once central to Europe’s antimony industry. During the Soviet era, Slovakia became Europe’s largest antimony producer, and Trojarova sits within this prolific belt.

The project hosts a historical resource of approximately 61,000 tonnes of antimony at an average grade of 2.478 percent—an in-situ value of roughly $3.66 billion at today’s prices.

Military Metals has filed an NI 43-101 technical report and digitized 14,300 meters of historical drilling and 350 underground channel samples. A Leapfrog geological model has been created to guide confirmation drilling, with permits already in progress.

Trojarova benefits from brownfield infrastructure and alignment with the European Union’s Critical Raw Materials Act, which is incentivizing domestic production of critical minerals through funding and streamlined permitting.

Tiennesgrund: District-Scale Potential in Slovakia

Tiennesgrund, in Eastern Slovakia, offers district-scale upside across 1,300 hectares. Historical mining between 1930 and 1939 produced 26,000 tonnes of ore grading 18–24 percent antimony.

Recent fieldwork has mapped accessible underground workings and analyzed five volumes of historical government reports. Indications suggest a 13-kilometer mineralized system, with potential tungsten by-product value. Exploration through 2025 will include trenching, geochemistry, and drill target delineation.

Last Chance: Rebuilding U.S. Antimony Production

In Nevada’s Toiyabe Range, the Last Chance Project is another historic antimony and gold producer. Located just 18 kilometers from Kinross’s Round Mountain Gold Mine, the site has seen little modern exploration.

Military Metals’ 2025 fieldwork revealed high-grade stibnite samples up to 11.6% antimony and identified multiple mineralized zones. Structural mapping and drill permitting are underway to advance this asset in a tier-one mining jurisdiction.

Strategic Tailwinds and Government Momentum

In April 2025, the U.S. excluded antimony from sweeping “Liberation Day” tariffs, underscoring its critical status. Meanwhile, the U.S.-Ukraine critical minerals agreement reflects Washington’s urgency in securing allied supply chains. But Ukraine lacks antimony resources—further elevating Military Metals’ Slovakian projects.

Canada’s $3.8 billion Critical Minerals Strategy and the EU’s raw materials funding programs add more tailwinds for companies advancing critical mineral projects.

A Valuation Gap With Asymmetric Upside

Perpetua Resources, with a historical resource of 90,000 tonnes of antimony, has surged to a $2 billion market cap. Military Metals, with 61,000 tonnes at Trojarova alone and a diversified asset base, trades at just $28 million.

Even if Military Metals were valued at just 10 percent of Perpetua’s current market cap, its valuation would rise to $200 million—nearly 7x its current market cap. That’s without factoring in its U.S. and Canadian projects or future government support.

Final Word

Antimony is no longer optional—it is the metalloid at the heart of modern warfare, renewable energy systems, and technological independence. From the hardened bullets and flame-retardant materials that kept soldiers alive in World War II, to the semiconductors, night vision systems, and batteries powering today’s militaries and economies, antimony is as indispensable now as it was a century ago. Yet Western nations remain dangerously dependent on supplies from China and Russia—countries whose export restrictions and geopolitical maneuvering have turned critical minerals into weapons of economic leverage.

Military Metals Corp., with its diversified portfolio of antimony assets across Canada, Europe, and the U.S., is positioning itself as a potential solution to this strategic vulnerability. Its projects are rooted in historic production but advanced with modern exploration, offering a rare combination of credibility, scalability, and jurisdictional safety. At just a $28 million market cap, the company sits at a fraction of the valuation of Perpetua Resources, despite holding a comparable antimony resource and operating in similarly favorable jurisdictions.

With fresh high-grade results from West Gore, an imminent drill program, and regulatory tailwinds in Nova Scotia accelerating timelines, Military Metals is rapidly emerging as one of the West’s most vital antimony players. For investors seeking asymmetric exposure to geopolitics, defense, and the energy transition, this under-the-radar small cap offers a unique chance to front-run what may become one of the most important supply chain stories of the decade.

DISCLOSURE

The author may own shares in Military Metals Corp. The author may choose to buy or sell shares at any time without notice. Although efforts have been made to ensure the accuracy and reliability of the information presented, readers are encouraged to conduct their own research and seek independent financial advice before making any investment decisions related to the small-cap company mentioned. Adam Giddens, a former CEO and now a director, was previously engaged as an Advisor to provide ongoing business support.