In the high-stakes world of mining, it pays to follow the money — especially when that money belongs to billionaires who’ve made fortunes betting on the right rocks.

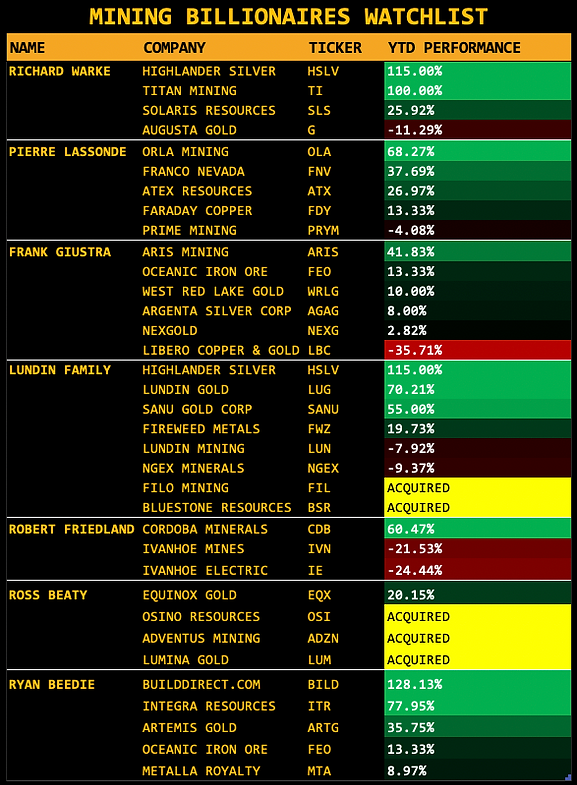

We’ve compiled a snapshot of what some of the most successful figures in the mining sector are holding in their portfolios right now — and how those positions are performing year-to-date in 2025.

This list includes heavyweights like:

- Richard Warke, known for blockbuster exits in copper and gold

- Pierre Lassonde, co-founder of Franco-Nevada

- Frank Giustra, the architect behind several mining booms

- The Lundin Family, with a dynasty spanning decades

- Robert Friedland, the ultimate wildcatter

- Ross Beaty, the “broken slot machine” of mining

- Ryan Beedie, who’s now stepping into the resource world with serious momentum

And the results? Some are crushing it — others, not so much.

Standout Winners

- BuildDirect (BILD) — Ryan Beedie’s pick is up a staggering +128.13% YTD, leading the pack. Not bad for a guy best known for real estate.

- Highlander Silver (HSLV) — Backed by both Richard Warke and the Lundins, HSLV has surged +115.00%, making it one of the hottest silver stocks in the market right now.

- Titan Mining (TI) — Another Warke-backed name, clocking in at +100.00%. Clearly, Warke’s touch is still gold (or silver… or zinc).

- Lundin Gold (LUG) — Up +70.21%, this is the crown jewel in the Lundin family’s gold empire.

- Cordoba Minerals (CDB) — A Friedland special, and it’s delivered +60.47% so far this year.

Underperformers & Acquisitions

Not every bet is printing money. Some big names have positions that are firmly in the red:

- Libero Copper (LBC) — Held by Giustra and down -35.71%

- Ivanhoe Electric (IE) — A Friedland venture, down -24.44%

- NGEx Minerals (NGEX) — Lundin-backed and down -9.37%

A few companies on the list, like Filo Mining, Bluestone Resources, Adventus Mining, and Lumina Gold, have been acquired — delivering exits instead of ongoing returns.

Key Takeaways

The billionaires are still betting big on gold, silver, and copper, with many placing chips on high-risk, high-reward juniors. But the divergence in performance shows just how volatile this sector can be — and how much timing matters.

For investors looking for inspiration — or confirmation — this watchlist offers a rare inside look at where the industry’s best are putting their money to work in 2025.

Disclaimer: The information in this article is for informational purposes only and does not constitute financial advice. The author does not own any of the stocks mentioned. While efforts have been made to ensure the accuracy of the data and numbers provided, they may not be accurate or up-to-date. Readers should conduct their own research and consult with a qualified financial advisor before making any investment decisions.