Investing in mining stocks, especially the small “junior” companies, is like buying a lottery ticket where you can actually improve your odds by doing a little homework.

The potential rewards are huge, but the risk is just as big. To make money, you don’t need a calculator; you need to understand the Story of a mine and the True Price you are paying for it.

Part 1: The Life of a Mine (The Story)

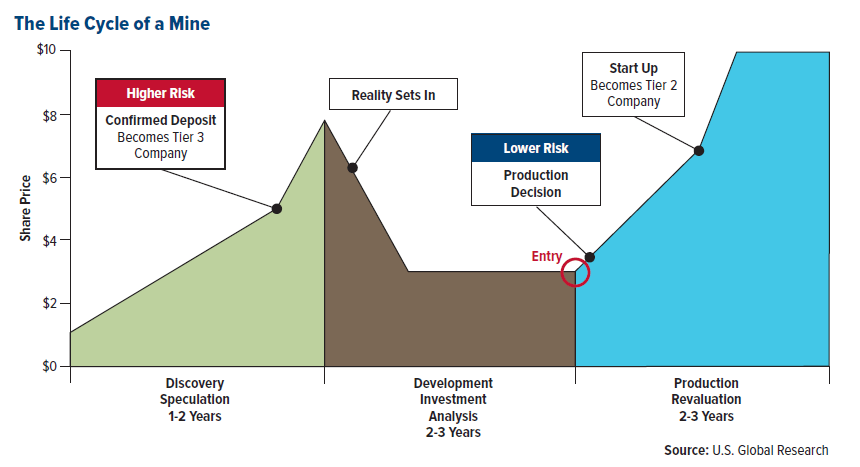

Every mining company is at a specific chapter in its life. Knowing which chapter they are in tells you how risky they are.

Stage 1: The Treasure Hunters (Exploration)

These companies represent the highest risk tier. They don’t own a mine yet; they possess a map, a theory, and a drill. essentially acting like a startup that has a great idea but hasn’t built a product yet. They drill holes in the ground hoping to find something valuable.

If they drill and find nothing, the stock price often crashes. However, if they hit a “glory hole”, a massive discovery, the stock can skyrocket 1,000% or more overnight.

Stage 2: The Architects (Development)

Once a company finds gold, copper, or silver, they enter the development phase. They must hire engineers to write detailed feasibility studies proving the mine is safe to operate and profitable. The risk here shifts from “is the gold there?” to “can they afford to build the mine?” Think of this stage as a startup that has a working prototype and is now seeking funding to build a factory.

Stage 3: The Giants (Production)

These are the major companies, like Barrick Gold or Rio Tinto, that own operating mines. They dig up metal, sell it, and generate cash flow. Because they are steady businesses, the risk is low, much like buying shares in an established blue-chip company like Ford or Coca-Cola.

Part 2: What is the Company Worth? (The Price Tag)

Beginners often look at the stock price ($0.50 vs $5.00) to see if a company is cheap. This is a mistake. A $0.50 stock can be expensive, and a $5.00 stock can be cheap.

To know the real value, you have to look at the “Whole Company Price.”

The “Whole Company” Concept (Enterprise Value)

Imagine you want to buy a house.

- House Price: $500,000

- Debts on the House: $100,000 that you have to pay off.

- Cash in the Safe: There is $50,000 cash sitting in the living room safe.

The Real Price you pay isn’t just the $500,000. You have to pay the debt, but you get to keep the cash.

- Real Price = House Price + Debt – Cash.

In Mining: Always check if the company has Debt (bad) or Cash (good). A company with zero debt and lots of cash is “cheaper” than it looks.

The “Grocery Store” Method (Value per Ounce)

You can also compare miners the way you compare fruit at the grocery store: by price per pound. In this industry, we use Price per Ounce.

Imagine Company A and Company B have both found 1 million ounces of gold.

- Company A is valued by the market at $100 million. You are essentially paying $100 for every ounce of gold they possess.

- Company B is valued at $50 million. You are paying only $50 for every ounce of gold they possess.

In this scenario, Company B is “on sale.” You are acquiring the same amount of gold for half the price.

Part 3: The Three Endings

When you purchase a small mining stock, the story generally concludes in one of three ways.

- The Bust: This is the most common ending. The company fails to find enough metal or runs out of money, and the stock slowly drifts to zero.

- The Buyout: This is the goal for most investors. The company discovers a great deposit, and a “Major” producer buys them out for a significant profit.

- The Unicorn: This is the dream scenario. The company finds a deposit so massive that they grow into a giant producer themselves. This is rare, but it is where life-changing money is made.

Summary Checklist for Beginners

Before you buy, ask these simple questions:

- [ ] Which Stage? Are they hunting (risky) or building (safer)?

- [ ] Cash in Bank? Do they have enough money to keep drilling for another year?

- [ ] The People: Have the people running the company ever built a successful mine before?

- [ ] The Price: Are they cheaper per ounce than their neighbors?