In an era where technological advancement and national defense hinge on access to rare and essential resources, critical minerals have emerged as a cornerstone of U.S. strategic priorities. These materials, ranging from rare earth elements to lithium, antimony, and copper, are vital for everything from electric vehicle batteries and renewable energy systems to military hardware and electronics. With global supply chains increasingly vulnerable to geopolitical tensions, particularly China’s dominance in mining and processing, the U.S. government has ramped up efforts to bolster domestic production and secure reliable sources. This push not only safeguards national security but has also sparked a surge in small cap stocks within the sector, turning obscure mining companies into market darlings amid rising commodity prices and investor enthusiasm.

The Government’s Proactive Stance on Critical Minerals

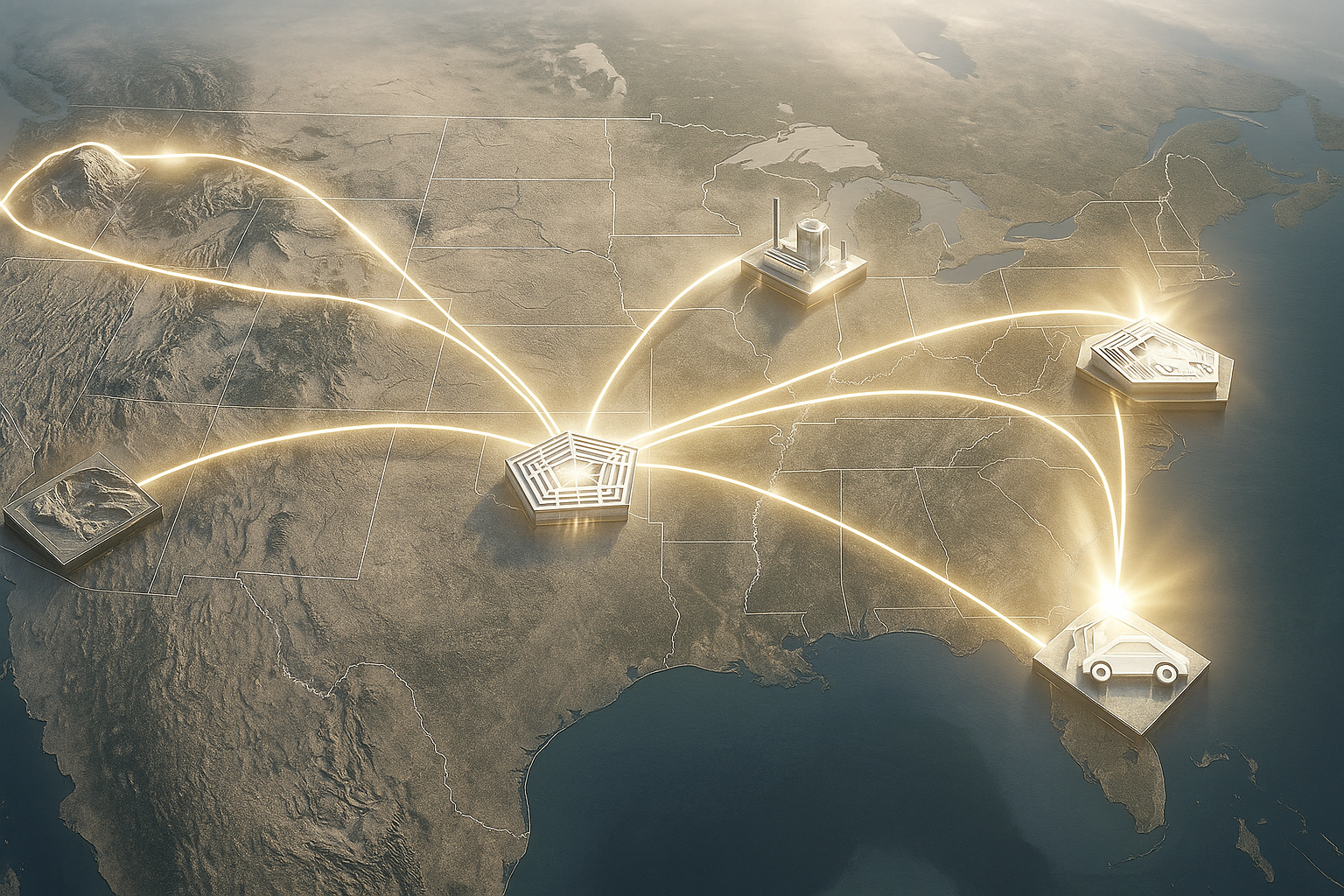

The Trump administration has made it clear: securing domestic supply chains for critical minerals is non-negotiable. Through executive orders, federal loans, and direct equity investments, the government is injecting billions into the industry to reduce reliance on foreign adversaries. This includes initiatives under the Department of Defense (DoD), Department of Energy (DoE), and the Office of Strategic Capital, aimed at accelerating exploration, extraction, and processing within the U.S. or allied territories. The goal? To ensure a resilient supply for defense stockpiles and high-tech industries, mitigating risks from export controls and market manipulations abroad.

Recent moves highlight this commitment. In March 2025, an executive order boosted American critical mineral production, followed by targeted investments that mark a new phase in Washington’s approach, taking direct stakes in companies to influence outcomes. This shift from traditional subsidies to equity ownership underscores the urgency, especially as China tightens controls on rare earth exports, driving up global prices and investor interest.

Key Companies Receiving Government Backing

Several small cap players have already benefited from this federal largesse, with investments propelling their projects forward and their stocks skyward.

- MP Materials (MP): As the operator of the only rare earth mine in the U.S., MP Materials secured a landmark deal in July 2025. The DoD invested $400 million for a 15% equity stake, plus a $150 million loan to expand rare earth magnet production. This public-private partnership aims to accelerate U.S. independence in magnet manufacturing, a sector critical for defense and EVs. Shares have surged 370% year-to-date, with an additional 63% gain post-announcement.

- Trilogy Metals (TMQ): In October 2025, the government announced a $35.6 million investment for a 10% stake in this Vancouver-based explorer, focused on the Upper Kobuk Mineral Projects (UKMP) in Alaska. The deal supports development of copper, zinc, and other critical minerals, tied to the approval of the Ambler Road project to unlock the region’s potential. Shares soared over 100% on the news, transforming the company from a micro-cap to a billion-dollar entity overnight.

- Lithium Americas (LAC): The DoE restructured a $2.26 billion loan for the Thacker Pass lithium project in Nevada, taking a 5% stake in the company and another 5% in its joint venture with General Motors. This equity infusion, finalized in late September 2025, ensures taxpayer protections while advancing the largest known lithium deposit in the U.S. Shares jumped 12% following the deal, despite broader market volatility in lithium prices.

Adding to the momentum, US Antimony Corp (UAMY) clinched a $245 million sole-source contract from the Pentagon in September 2025 to replenish defense stockpiles of antimony, a key component in munitions and flame retardants. Sourced from Alaska and refined in Montana, this five-year deal marks the first major replenishment in decades, sending shares surging as deliveries began immediately. The stock is up over 1500% this year, reflecting the explosive growth in the sector.

Broader Market Surge and Emerging Players

The ripple effects are evident: almost all U.S.-based critical minerals companies have seen their stocks fly, fueled by government support and escalating global demand. For instance:

- Critical Metals Corp (CRML): Shares rocketed 65% in just five days amid speculation of a potential U.S. government stake in its massive rare earth deposit, though officials later downplayed the reports. Recent China export curbs pushed the stock up another 18%, with a 70% gain over the past year.

- TMC the Metals Company (TMC): This deep-sea mining innovator climbed 560% in 2025, hitting a 52-week high of $9.55 amid U.S. interest in seabed nodules rich in nickel, cobalt, and manganese. September alone saw an 18.8% rise, with shares up 818% year-over-year as regulatory approvals loom.

Looking ahead, more companies could join the fray as the administration eyes additional stakes to counter China’s influence.

Spotlight on Military Metals Corp (MILI): A Potential Game-Changer in Antimony

Amid the antimony boom, Military Metals Corp stands out as an emerging player poised for significant upside, even without direct government funding yet. Focused on challenging China’s near-monopoly on antimony—a mineral crucial for military applications like armor-piercing projectiles, night-vision goggles, and flame retardants—the company is advancing high-potential projects with modern exploration techniques.

Key highlights include the West Gore project in Nova Scotia, Canada, a historic antimony-gold district being revitalized with cutting-edge geophysical surveys and drilling. Military Metals also eyes European sourcing to diversify supply chains, aligning perfectly with U.S. efforts to friend-shore critical minerals. With antimony prices skyrocketing from around $6 per pound to over $20 per pound in 2025 due to Chinese export restrictions, the company’s deposits with substantial tonnage in the ground position it as a strategic asset.

While not yet a recipient of federal investments, Military Metals could be next in line as the Pentagon prioritizes domestic and allied reserves. Moreover, industry consolidation looms: US Antimony Corp, currently primarily an antimony smelter with its stock up over 1500% this year, could be a suitable acquirer. By acquiring antimony deposits like those held by Military Metals, US Antimony could backfill its valuation, integrating upstream resources to create a fully vertical supply chain and further capitalize on the national security-driven demand.

This speculative synergy adds intrigue, as mergers in the sector could accelerate development and unlock value for small cap investors betting on the critical minerals renaissance.

The Investment Opportunity in Small Caps

For small cap investors, this government-driven boom presents a golden window. With federal backing de-risking projects and inflating valuations, stocks in the critical minerals arena are outperforming broader markets. However, volatility remains, tied to commodity prices, regulatory hurdles, and geopolitical shifts. As the U.S. continues to build resilient supply chains, expect more announcements that could propel additional players upward. Keep an eye on this sector; it’s not just about national security, it’s about substantial returns.

DISCLAIMER: The author did not receive any compensation for publishing this article. The author holds a position in Military Metals and may choose to buy or sell shares of the company at any time without notice. The author does not hold positions in any of the other companies mentioned. While reasonable efforts have been made to ensure the accuracy and reliability of the information provided, readers are encouraged to conduct their own research and seek independent financial advice before making any investment decisions related to the companies discussed.