Every few years, the crypto market flips into a different gear. Bitcoin takes a breather, traders start rotating into altcoins, and the percentage moves get downright absurd.

We’re talking 2x, 5x, even 50x, sometimes in a matter of weeks, not years.

If you’ve been through a cycle before, you know when it’s happening. The signs are obvious. And right now, they’re flashing everywhere.

Bitcoin dominance, BTC’s share of the overall crypto market cap, just broke down after an 18-month uptrend. In every past cycle, that’s been the green light for alt season.

The playbook is always the same:

- Bitcoin runs first.

- BTC dominance peaks.

- Ethereum takes over.

- Altcoins explode.

We saw it in 2013, 2017, and 2020–21. And now, it’s setting up again in 2025.

Ethereum’s Already Running the Show

Ethereum’s been doing exactly what it always does in the early days of alt season, outperforming Bitcoin. In mid-July, ETH broke $3,150 for the first time in months. Just a few weeks later, it blew through $4,000 for the first time this year.

ETF inflows, the Dencun upgrade cutting gas fees, a U.S. executive order allowing crypto in 401(k)s, and even rumors that BlackRock is preparing an XRP ETF, the catalysts are stacking up. ETH is dragging the broader alt market higher.

The Indicators All Say the Same Thing

- Altcoin Season Index is over 75 — meaning 75%+ of the top 50 alts are outperforming BTC.

- Altcoin market cap is up 20%+ in two weeks.

- USDT dominance is under 4%, showing traders are putting capital to work.

- On-chain data shows accumulation in smaller-cap alts.

Memecoins are ripping triple digits. Crypto Twitter’s back to chest-thumping. Influencers are cranking out “alt season portfolio” videos. The rotation is happening.

SharpLink Gaming (NASDAQ:SBET): The Ethereum Treasury Play

SharpLink Gaming isn’t a gaming company anymore. The business now boils down to one thing: holding Ethereum.

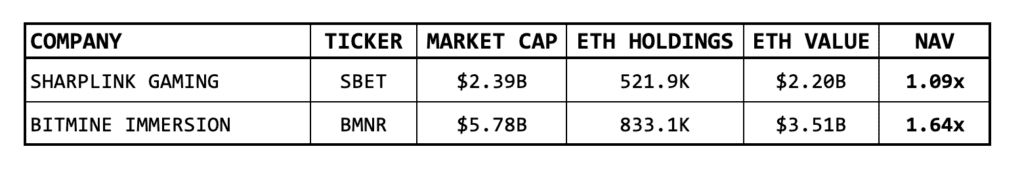

Right now, SharpLink owns nearly 522,000 ETH, worth roughly $2.20 billion. The company’s market cap? About $2.39 billion. That means the stock is trading at just 1.09x its net asset value (NAV).

For context, Bitmine Immersion ($BMNR) — which runs essentially the same Ethereum treasury model — trades at 1.78x NAV. If SBET were to re-rate to match BMNR’s multiple, the company’s market cap would jump to $3.6 billion, or $36.09 per share — a 50.5% gain from current levels.

Note: SharpLink currently has an active At-The-Market (ATM) equity program, along with a recently announced $200 million financing at $19.50 per share. These transactions will increase the company’s share count, but also boost its cash and ETH holdings, since management intends to convert proceeds into Ethereum, both the NAV numerator (ETH value) and denominator (market cap) will rise proportionally. In the short term, the ongoing dilution has been a major headwind, helping explain why SBET has lagged BMNR despite a similar Ethereum-treasury model. I expect this valuation gap to narrow as the financing overhang clears.

SBET’s also making moves to get more attention from serious money. They recently hired Joseph Chalom, who was previously Co-CEO at BlackRock, the largest asset manager on the planet. That kind of hire signals they’re not just sitting on ETH — they’re building an institutional-grade story around it.

The stock is already up more than 350% this year, and ETH has barely gotten started. If ETH becomes the driver of this alt season, SBET’s combination of undervaluation and leverage could make it one of the standout public market plays in crypto.

Spetz Inc. (CSE:SPTZ): Sonic Strategy’s Public Market Proxy

If you missed Solana’s run last cycle, you probably also missed SOL Strategies (CSE:HODL) — the public vehicle that went from $0.25 to $6 in a matter of months as Solana exploded.

Spetz Inc. is aiming to be that play for Sonic ($S).

Sonic isn’t just another chain. It’s the upgraded, rebranded version of Fantom (FTM), one of the breakout names of the last bull run. Fantom went from under 2 cents to over $3.60 at its peak, thanks to a booming DeFi ecosystem and lightning-fast transactions.

Sonic takes it further:

- 10,000+ transactions per second.

- A revenue model that gives developers up to 90% of transaction fees (vs. ~30% on most chains).

- Already over $1 billion in total value locked in just two months.

And the institutional interest is already starting to stir — Sonic Labs, the creator of $S, recently hinted that NASDAQ-listed public treasury companies are exploring adding $S to their balance sheets.

NASDAQ-listed public treasury companies are exploring adding $S to their balance sheets.

— Sonic Labs (@SonicLabs) August 9, 2025

🇺🇸🗽

Spetz’s playbook is simple:

- Accumulate Sonic tokens.

- Run validators, stake, and deploy in DeFi to generate yield.

- Compound that yield to grow the treasury over time.

This is the MicroStrategy model, but on a high-growth Layer 1 chain instead of Bitcoin. And because Sonic is still early, the potential upside could dwarf what we’ve seen from older, more mature chains.

For investors, $SPTZ is the easiest way to get exposure to Sonic without touching wallets, staking setups, or DeFi protocols. You buy the stock, and you’re effectively holding a piece of the Sonic network plus the income it generates.

If Sonic captures even a fraction of the momentum Solana had in 2021, $SPTZ could be one of the fastest-moving blockchain equities in the market.

The Clock’s Already Ticking

Alt seasons don’t drag on for years. In 2017 and 2021, the biggest moves happened in tight, furious bursts, sometimes just a few weeks from liftoff to peak.

Right now, BTC dominance has cracked, ETH is leading, and the altcoin market is in full risk-on mode. SBET and SPTZ are sitting right in the middle of that setup.

As always, this isn’t financial advice. But history doesn’t repeat—it rhymes. And the music’s getting louder.

Disclosure

The author did not receive any compensation for publishing this article. The author owns shares of Spetz Inc and Sharplink Gaming and may choose to buy or sell at any time without notice. While the author has made reasonable efforts to ensure the accuracy and reliability of the content, readers should conduct their own research and analysis and seek independent financial advice before making any investment decisions related to the small cap company mentioned.