This Article was Disseminated on Behalf of Axcap Ventures.

Sell in May and Go Away? Not This Time — Why Gold Juniors Are Set to Shine

There’s an old stock market adage: “Sell in May and go away.” Historically, it’s been a warning to investors that summer is a dull season — marked by low volume, sluggish returns, and capital flowing to the sidelines.

But this year? That wisdom’s looking obsolete.

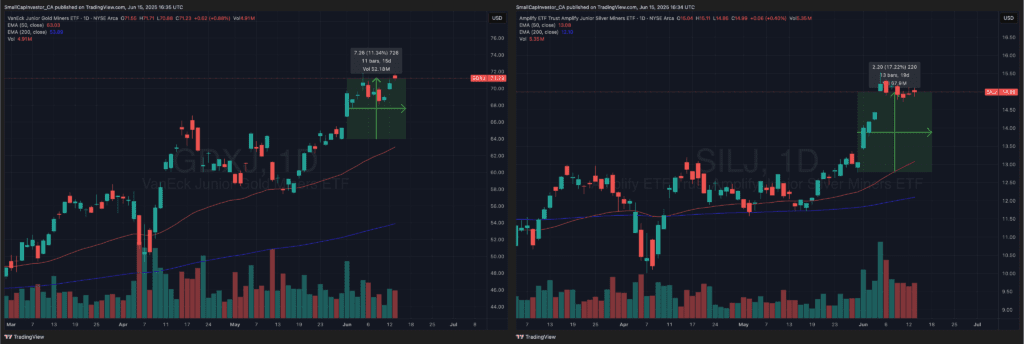

In the first two weeks of June alone, the GDXJ index — which tracks junior gold miners — is up 11.34%, while the SILJ index of junior silver miners has surged an astonishing 17.22% off their May 30th lows. These are not the moves of a sleepy summer market. They are signals — flashing ones — that we may be entering the first innings of a powerful bull run in precious metals equities.

And if history is any guide, the biggest upside during these cycles comes not from the majors — but from the juniors. The producers have largely moved. The real alpha is now downstream: in the developers and the explorers.

The World Is Turning Risk-Off — and Gold Is Back in the Spotlight

Beyond technicals, the macro backdrop is adding fuel to the fire.

On June 13th, the long-simmering tensions between Iran and Israel escalated dramatically in what is now being called Operation Rising Lion. This isn’t a border skirmish — it’s a geopolitical powder keg. And as the risk of a wider regional war grows, global capital is responding the way it always has during uncertain times: by flowing into safe havens.

Gold prices have jumped sharply.

This isn’t a speculative trade anymore. It’s capital preservation. It’s insurance. And gold — particularly high-quality gold equities — is emerging once again as one of the most effective ways to position for a volatile world.

Why Juniors Offer the Best Upside

We’ve seen this setup before. When the majors move, retail and institutional capital alike begin searching for leveraged exposure. That demand trickles down — to developers with defined ounces and near-term catalysts, and explorers sitting next to high-grade discoveries.

In short: we’re entering a stock picker’s market in the gold space.

And here are four junior names I’m watching closely — each positioned to outperform as this cycle unfolds:

1. Axcap Ventures (CSE: AXCP)

Axcap Ventures is executing a simple but highly effective strategy: acquire undervalued gold ounces in the ground in Tier-1 jurisdictions, clean up the technicals, and flip them at a premium. With holdings across Nevada, British Columbia, and Wyoming, the company is focused on politically stable, mining-friendly regions where majors are actively shopping for ounces.

So far, Axcap has secured nearly 8 million ounces of gold for under $5/oz — a staggering discount when you consider that recent M&A deals have priced ounces anywhere from $40 to $80. This isn’t a grassroots explorer — it’s a strategic consolidator run by operators with a track record of building and monetizing assets.

With inflation driving up capex across the board, majors are increasingly looking to buy ounces rather than build them. That makes Axcap’s model — find it cheap, package it smart, sell it high — incredibly timely. The market still hasn’t priced in just how scalable and lucrative this business plan could be.

2. Sanatana Resources (TSXV: STA)

Sanatana is an early-stage explorer with a land position most juniors could only dream of. Its newly staked Goldstrike Two project in the Yukon sits adjacent to Snowline Gold’s Rogue discovery — arguably the most important gold find in Canada in recent memory.

The appeal here isn’t just location, though that’s a major part of it. Goldstrike Two lies within the same RIRGS (Reduced Intrusion-Related Gold System) corridor that hosts Rogue, and preliminary data suggests similar structural and geological features. That doesn’t guarantee success — nothing in exploration does — but proximity and geology together make for a very compelling start.

What adds another layer of intrigue is the vendor: the Florin Group, a well-known player in the district with additional assets that are highly sought after. In a recent statement, Florin Group principal John Fiorino noted: “The Florin Group looks forward to engaging in further discussions with Sanatana’s management to explore possible additional mineral property transactions, identifying opportunities where our complementary strengths can drive mutually beneficial transactions.”

Read between the lines, and it’s clear Sanatana could be positioning itself for further acquisitions to consolidate its foothold in this emerging gold district. While drilling isn’t expected just yet, fieldwork is ramping up — and with the right results, this could quickly evolve into one of the Yukon’s most interesting junior exploration stories.

3. Augusta Gold (TSX: G)

If you believe in the gold M&A cycle, Augusta Gold is a name to know. Backed by billionaire mining financier Richard Warke, Augusta holds two fully permitted, construction-ready gold projects — Bullfrog and Reward — located near the town of Beatty, Nevada. Combined, the assets boast a net asset value of over $680 million based on today’s gold price. Yet the company trades at a fraction of that, thanks to limited promotion and a near-total absence of retail awareness.

What sets Augusta apart is that it’s already done the heavy lifting. These aren’t exploration targets — they’re de-risked development projects sitting in a top-tier jurisdiction, with infrastructure in place and neighbors like AngloGold Ashanti actively consolidating the region. Warke has a long history of building and selling companies at billion-dollar valuations. Augusta could be next. Whether through production or acquisition, the value disconnect here is hard to ignore.

4. K2 Gold (TSXV: KTO)

K2 Gold controls one of the most overlooked high-grade oxide gold projects in the United States: the Mojave Project in California’s Inyo County. This 5,800-hectare land package has seen significant historical drilling, including standout intercepts like 4.0 grams per tonne over 86.9 meters and 1.0 gram over 122 meters — exceptional grades for near-surface oxide mineralization.

The project has the scale, grade, and logistics to be a company-maker. What’s held it back is permitting. But that roadblock may soon be removed. A decision from the Bureau of Land Management is expected soon, and if approval comes through, Mojave could immediately move into the spotlight as one of the few advanced, high-impact U.S. gold projects with both size and grade. In a market hungry for American gold assets, K2’s rerate window is wide open.

Final Thoughts

Something changed in June. The world edged closer to the brink — and capital is reacting.

For the first time in a while, gold isn’t just a commodity. It’s a political hedge. A monetary hedge. And most importantly — a contrarian investment opportunity as equities hang near all-time highs while global instability brews just beneath the surface.

In this kind of environment, gold juniors aren’t just speculative trades — they’re leveraged insurance.

The majors have had their run. Now, the juniors are waking up.

Disclaimer

Torque Capital Partners (“we” or “us”) are not registered brokers, dealers, investment advisors, or financial advisors. The information contained in this article is for informational and educational purposes only and should not be construed as investment advice or a recommendation to buy or sell any securities. Always conduct your own due diligence before making investment decisions, including reviewing the relevant company filings on SEDAR+, EDGAR, or other regulatory databases.

Axcap Ventures Inc. has paid Torque Capital Partners a one-time fee of USD $200,000 for a three-month marketing and awareness campaign. We or certain non-arm’s length parties currently hold 600,000 common shares of Axcap Ventures Inc.

Additionally, we hold positions in all companies mentioned in this article — including Axcap Ventures, Sanatana Resources, Augusta Gold, and K2 Gold — and may buy or sell shares at any time without notice. No compensation was received from any of the other issuers named in this article.

This article does not constitute an offer to sell or a solicitation of an offer to buy any securities. All investments carry risk, and the securities of junior mining and exploration companies should be considered highly speculative. Examples of past share price movements or performance are provided for illustrative purposes only and are not indicative of future results. Readers are encouraged to independently verify all information and consult a licensed financial advisor before making any investment decision.

While the information herein is believed to be accurate and sourced from publicly available materials, including company press releases, regulatory filings, and official websites, we cannot guarantee its accuracy or completeness.