I want to start this off by saying that this is not a paid article. I’m writing about this company because I see a rare opportunity to spotlight a grossly mispriced asset before the market wakes up. My conviction comes from experience: I’ve written about Augusta Group companies like Newcastle Gold and Arizona Mining before their multi-billion-dollar buyouts, and I’m confident Augusta Gold is following the same playbook…

Gold has broken through $3,300 per ounce in 2025, a level few expected this quickly. And yet, Augusta Gold Corp. (TSX: G, OTCQB: AUGG), with two development-stage gold projects in Nevada’s red-hot Beatty District, continues to trade under $1.00. On the surface, that seems like the market has passed it over. But a deeper look reveals a different picture: Augusta may be one of the most mispriced assets in the sector.

The company owns the fully permitted, construction-ready Reward project, as well as the district-scale Bullfrog project, formerly owned by Barrick and situated beside AngloGold Ashanti’s billion-dollar land package. Together, these assets form a compelling portfolio: de-risked, scalable, and located in the best mining jurisdiction on the planet.

Unlike most juniors chasing promotional buzz, Augusta Gold operates with restraint. It doesn’t flood inboxes with news releases or court retail sentiment. That’s not the strategy. Led by billionaire Richard Warke and the Augusta Group, responsible for over $4.5 billion in past mining exits, this team executes quietly, letting the projects speak for themselves.

Richard Warke and the Augusta Group Playbook

Richard Warke is one of the most successful entrepreneurs in modern mining. His track record includes the $1.6 billion sale of Ventana Gold, the $667 million exit of Augusta Resource, and the $2.1 billion acquisition of Arizona Mining. He also co-founded Equinox Gold, now worth more than $3 billion. These are not flukes, they’re a blueprint. Warke identifies quality assets, surrounds them with elite teams, and advances them until the market, or a major, pays attention.

Augusta Gold is his next act. Yet in keeping with the Augusta Group’s style, the company hasn’t gone out of its way to court the market. Communications are infrequent. Retail marketing is virtually nonexistent. But this lack of noise shouldn’t be mistaken for inaction. If anything, the group’s quiet approach has historically preceded some of the biggest mining wins of the past decade.

Reward Project: Ready to Build

The Reward project is the company’s short-term catalyst. Located just seven miles from AngloGold Ashanti’s Sterling Mine, Reward is fully permitted and construction-ready — a rarity among junior developers. The 2024 feasibility study outlines a straightforward open-pit, heap-leach operation with 370,000 ounces of proven and probable reserves. Average annual production is expected to be 39,000 ounces over a 9.5-year mine life, with peak output approaching 47,000 ounces. Metallurgical recoveries are estimated at 79%, and all-in sustaining costs are projected at just $1,200/oz.

While those economics already look attractive, they were modeled using a gold price of $2,400/oz. At today’s $3,300 gold, the valuation jumps significantly. Using project sensitivity data and adjusting for higher prices, Reward’s after-tax NPV increases from $126.9 million to an estimated $291.6 million. When you factor in synergies with local infrastructure, like the nearby processing capacity at AngloGold’s Sterling site, the NPV climbs to approximately $301.6 million.

And now, the company has a potential game-changer: on June 16, 2025, Augusta Gold announced that the Export-Import Bank of the United States (EXIM) issued a Letter of Interest (LI) for up to $50 million in project financing under its Make More in America initiative. The LI outlines EXIM’s preliminary intent to provide a long-term, competitively priced loan for construction of the Reward project — covering more than 50% of estimated capex.

This is not just a financial milestone; it’s a massive de-risking event. U.S. government backing — even at the letter-of-interest stage — sends a strong signal to the market about Reward’s viability, strategic relevance, and near-term production potential. In the words of CEO Don Taylor, this “should drive an equity re-rate.”

Reward now stands as one of the most advanced and well-supported development projects in North America — shovel-ready, permitted, and backed by one of the most credible lenders in the country.

Bullfrog Project: Long-Term Growth, Major Upside

If Reward represents the cash engine, Bullfrog is the long-game value driver. The project hosts over 1.2 million ounces in measured and indicated gold resources and another 258,000 ounces inferred, spread across three historical zones: Bullfrog, Bonanza Mountain, and Montgomery-Shoshone. Metallurgical testing supports recoveries of 80% or more, and the oxide-rich profile adds flexibility to future mine design.

Bullfrog is located next to AngloGold Ashanti’s Expanded Silicon (Arthur) project, a $5 billion development in the same district. AngloGold has already invested over $700 million in consolidating Beatty, and Augusta’s land package sits in the middle of it all. With 820 claims and multiple expansion targets, Bullfrog is one of the few remaining independent properties of scale in the area.

Despite not yet being permitted, Bullfrog’s potential value is clear. A DCF model factoring in a moderate capex estimate, 10-year mine life, and adjusted operating costs yields a pre-stage discount NAV of $733 million. Applying a balanced 40% discount to reflect development risk and permitting timelines brings Bullfrog’s net contribution to approximately $439.8 million.

This doesn’t even account for exploration upside. Drilling has only scratched the surface, and high-priority zones like the Gap target remain largely untested. As permitting progresses and development capital becomes more accessible, Bullfrog’s value should become harder for the market to ignore.

Not All Gold Ounces Are Equal

There’s a tendency in mining to treat all ounces the same. But that’s a mistake. Ounces in Nevada, especially those near infrastructure and in politically stable jurisdictions, deserve a premium. Reward is permitted and construction-ready. Bullfrog is large-scale and strategically located in one of the most active gold consolidation zones in the world. Together, they are not just ounces, they’re near-term assets with institutional-grade appeal.

Valuation: What Is Augusta Actually Worth?

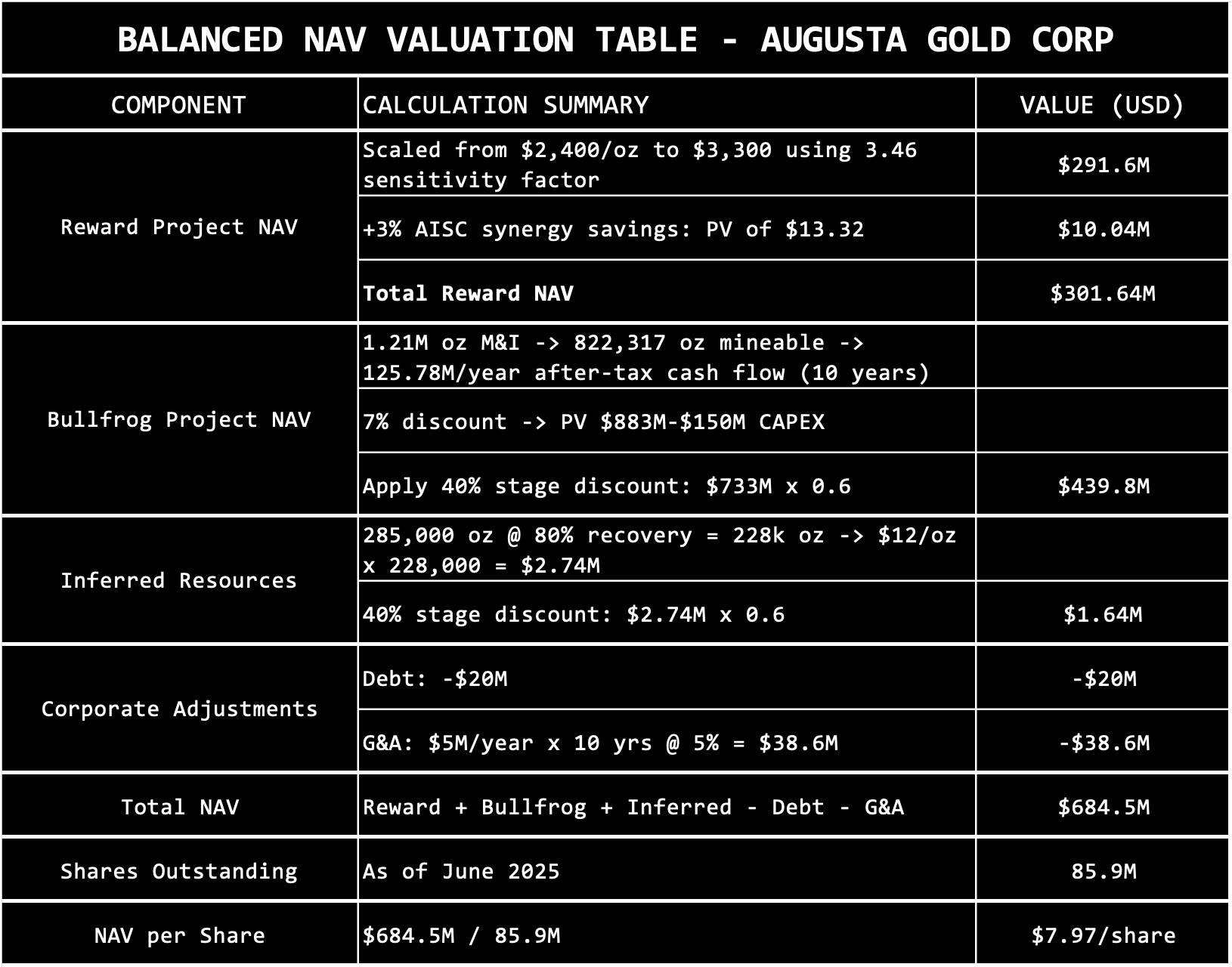

Using updated gold prices and a realistic DCF framework, Augusta Gold’s Net Asset Value stands at approximately USD $684.5 million (CAD $935M). That includes a $301.6 million contribution from Reward, $439.8 million from Bullfrog, and a modest $1.6 million for inferred resources, offset by $20 million in estimated debt and $38.6 million in discounted G&A obligations.

With 85.9 million shares outstanding, Augusta’s NAV per share is approximately USD $7.97 (CAD $10.89). Yet the company continues to trade at CAD $1.00, implying a valuation less than 10% of NAV.

Even if one applies a conservative industry-standard multiple of just 0.5x NAV, the stock would still be worth $3.99/share, significantly higher than today’s market price.

What’s Holding It Back? And Why That Could Change Fast

Augusta Gold hasn’t chased market attention. That’s been a drag on the share price, especially among retail investors. Add to that a capital structure involving insider debt, and the stock has remained off most radar screens.

But those headwinds also explain why the upside is so dramatic. The Reward project is months from production, not years. Bullfrog’s proximity to AngloGold and scalability make it a strategic prize. And Warke’s team has a habit of unlocking value quietly, until it’s too large to ignore.

Once financing is secured or a joint venture is announced, the market will have to recalibrate.

Conclusion: The Market Hasn’t Weighed Augusta Yet, But It Will

Augusta Gold is not a high-risk grassroots explorer. It is a near-term producer with a fully permitted project in the best mining jurisdiction on earth, backed by a management team that has delivered billions in value across multiple cycles.

At $1.00, the stock is trading for less than one-tenth of its NAV, based on a balanced, fully modelled assessment. And with gold sitting above $3,300/oz, the timing couldn’t be better for a re-rate.

As Benjamin Graham said, “In the short run, the market is a voting machine, but in the long run, it is a weighing machine.”

That weighing machine is about to find Augusta Gold a lot heavier than it looks.

DISCLOSURE

The author did not receive any compensation for publishing this article. The author owns shares of Augusta Gold and may choose to buy or sell at any time without notice. While the author has made reasonable efforts to ensure the accuracy and reliability of the content, readers should conduct their own research and analysis and seek independent financial advice before making any investment decisions related to the small cap company mentioned.